But one point made by a spokesperson from Infometrics irked me:

"... if people are worried about passing on money to their children when they die, people's increasing life expectancies mean that inheritances are often being received by children when they are themselves retired and don't really need the money..."Apart from the obvious, that it is the individual's business what he or she does with his or her money, this statement, as a generalization, makes a false assumption.

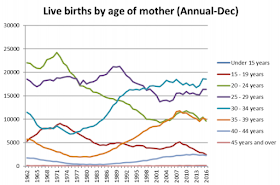

Yes, people are living longer but they are having children later. Consider this graph depicting the age of mothers:

Teenage births now match those of the over 40s. The next two most divergent age groups (20-24 and 35-39 years) have also merged and 30-34 has grown from being the 4th (in 1974) to 1st most common age for child-bearing.

And that doesn't take into consideration the age of fathers. There are 44 years between my youngest and my husband and that's not terribly unusual.

Increasingly parents will reach their life expectancy (and hopefully go beyond) while their offspring are a long way from retirement.

I am old enough to have contributed to two superannuation schemes destroyed by National governments. The first had accumulated a pot of money that equalled the national debt of the day, so Muldoon legislated to steal it and placed it into that Black-Hole called the consolidated fund. I recall him rasping "Dont worry, there will ALWAYS be a National Superanuation for the retired!"

ReplyDeleteAt least I got a few dollars back from the second one they scrapped

........